Navigating the Complex World of Financial Management

Finance is the heartbeat of any organization, influencing every decision and shaping the trajectory of success. In this exploration of finance, we delve into key aspects that define the financial landscape and discuss strategies for effective financial management.

Financial management is a critical aspect of both personal and organizational success, involving the efficient utilization and strategic allocation of financial resources. At the individual level, it encompasses budgeting, saving, and investing to achieve financial goals. Effective financial management empowers individuals to build wealth, navigate economic uncertainties, and plan for future needs such as education, homeownership, and retirement.

For businesses, financial management extends to optimizing cash flow, making informed investment decisions, and ensuring the long-term sustainability of operations. It involves financial planning, risk assessment, and maintaining a healthy balance between debt and equity.

Understanding the Basics of Financial Management

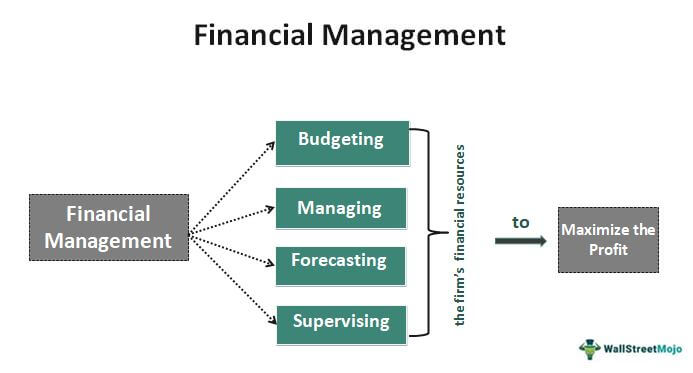

At its core, financial management involves the strategic planning, organizing, directing, and controlling of an organization’s financial resources. This includes budgeting, financial forecasting, cash flow management, and financial reporting. A solid understanding of these fundamentals is crucial for businesses to make informed decisions and ensure long-term sustainability.

Navigating the World of Investment

Investment decisions play a pivotal role in the financial health of any organization. From capital expenditures to portfolio management, businesses must carefully assess risk and return. This section explores the diverse avenues of investment, including stocks, bonds, real estate, and emerging investment trends. A well-balanced investment strategy aligns with organizational goals and risk tolerance, fostering growth and financial stability.

Risk Management: Mitigating Financial Uncertainties

In the dynamic world of finance, uncertainties are inevitable. Effective risk management involves identifying, assessing, and mitigating potential risks that could impact financial goals. This can include market risks, credit risks, operational risks, and more. Businesses that prioritize risk management not only safeguard their financial well-being but also build resilience in the face of unforeseen challenges.

The Role of Financial Institutions

Financial institutions serve as the backbone of the financial system, providing essential services such as banking, lending, and investment. Understanding the relationship between businesses and financial institutions is crucial. This section explores the various financial instruments and services offered by banks, investment firms, and other financial entities. Building strong partnerships with these institutions is often key to accessing capital and managing financial transactions efficiently.

Embracing Financial Technology (FinTech)

The rise of financial technology has transformed traditional financial processes. From mobile banking to blockchain, FinTech innovations are reshaping the financial landscape. Businesses that embrace FinTech solutions gain efficiency, speed, and enhanced security in their financial transactions. This section explores the latest FinTech trends and highlights how businesses can leverage technology to streamline financial operations.

Financial Planning for Sustainable Growth

Strategic financial planning is essential for long-term success. This involves setting realistic financial goals, creating budgets, and monitoring financial performance. Businesses that align their financial planning with overall strategic objectives can make informed decisions, allocate resources effectively, and position themselves for sustainable growth.

Compliance and Ethics in Finance

In an era of increased scrutiny, maintaining financial integrity is non-negotiable. This section delves into the importance of ethical financial practices and compliance with regulatory standards. Businesses that prioritize ethical conduct build trust with stakeholders, protect their reputation, and navigate the complexities of legal and regulatory frameworks.

Conclusion: Navigating the Financial Landscape

In conclusion, finance is a multifaceted discipline that requires a comprehensive understanding and strategic approach. Whether it’s mastering financial management basics, making sound investment decisions, mitigating risks, leveraging technology, or ensuring ethical practices, businesses must navigate the financial landscape with precision. By adopting effective financial strategies, organizations can not only weather economic uncertainties but also thrive in an ever-evolving financial ecosystem.

Read More : Mastering the Art of Finance: Strategies for Financial Success