A Comprehensive Guide to Finance Strategies

Finance is the lifeblood of every business, influencing strategic decision-making, growth trajectories, and overall stability. In this comprehensive guide, we delve into various facets of finance, exploring key strategies that organizations can employ to optimize financial health and drive success.

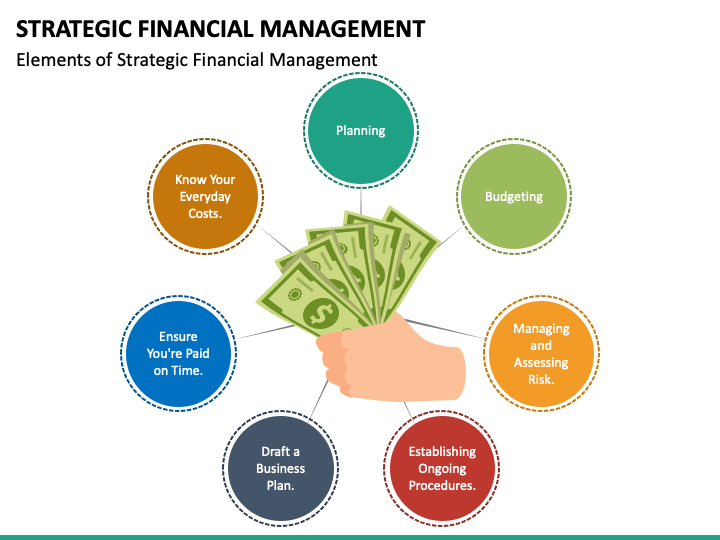

A comprehensive guide to finance strategies is essential for individuals and businesses seeking financial success. This guide encompasses a range of principles, from budgeting and investment to risk management and long-term planning.

Budgeting forms the foundation, helping individuals and businesses allocate resources wisely. Tracking income and expenses ensures financial stability and enables strategic decision-making. Saving and investing are key components, with diversified portfolios, retirement plans, and emergency funds serving as pillars for financial security.

Risk management is crucial, necessitating a careful evaluation of potential financial pitfalls. This includes insurance coverage, emergency preparedness, and hedging strategies in investments. Long-term planning involves setting clear financial goals and developing strategies to achieve them. This could involve debt reduction, wealth accumulation, or planning for major life events.

1. A Comprehensive Guide to Finance Strategies Long-Term Success

At the core of financial excellence lies strategic planning. Effective financial planning involves setting clear objectives, creating realistic budgets, and forecasting future financial scenarios. Businesses that invest in meticulous financial planning are better equipped to navigate uncertainties, allocate resources efficiently, and position themselves for sustained growth.

2. The Role of Efficient Budgeting in Financial Management

Budgeting is a fundamental tool for financial control and accountability. Establishing a well-structured budget helps organizations monitor expenses, identify cost-saving opportunities, and allocate resources judiciously. Through the implementation of efficient budgeting practices, businesses can maintain financial discipline and optimize their operational efficiency.

3. Capital Structure Optimization: Balancing Debt and Equity

Achieving an optimal capital structure is crucial for financial stability. Balancing debt and equity allows businesses to manage financial leverage effectively. Striking the right balance ensures that organizations can access the necessary funding for growth without exposing themselves to undue financial risks. It’s a delicate dance that requires careful consideration of the cost of capital and the risk tolerance of the business.

4. Risk Management: Safeguarding Financial Stability

In the unpredictable world of business, risk management is paramount. Identifying potential risks, whether they be market fluctuations, regulatory changes, or geopolitical uncertainties, allows businesses to implement strategies to mitigate these risks. From insurance solutions to diversifying investments, effective risk management safeguards financial stability and protects the organization from unforeseen challenges.

5. Embracing Technology in Financial Operations

In the digital era, technology is reshaping the financial landscape. Automation, artificial intelligence, and blockchain technologies are revolutionizing financial operations. Businesses that leverage these technologies can enhance the accuracy and efficiency of financial processes, from accounting and invoicing to payroll and financial reporting.

6. Financial Analytics for Informed Decision-Making

Data-driven decision-making is a hallmark of successful financial management. Implementing financial analytics tools allows organizations to gain valuable insights into their financial performance. Analyzing key metrics, trends, and forecasting models empowers businesses to make informed decisions, identify opportunities for improvement, and adapt to changing market conditions.

7. Regulatory Compliance: Navigating the Complex Landscape

Adhering to regulatory requirements is non-negotiable in the financial realm. Businesses must stay informed about changes in financial regulations and ensure compliance to avoid legal and financial consequences. Establishing robust internal controls and engaging with legal and compliance professionals are essential components of maintaining financial integrity.

Conclusion:

In conclusion, A Comprehensive Guide to Finance Strategies mastering the financial landscape requires a holistic approach that encompasses strategic planning, efficient budgeting, optimal capital structure, risk management, technological integration, and regulatory compliance. By adopting these key strategies, businesses can not only navigate the complexities of finance but also position themselves for long-term success and resilience in an ever-changing economic environment.

Read More : Decoding the Dynamics of Business: A Holistic Perspective